arizona estate tax exemption 2020

541 which increased the Vermont estate tax exemption to 4250000 in 2020 and 5000000 in 2021 and thereafter. Estate tax exemption amount.

Arizona Estate Tax Everything You Need To Know Smartasset

259 on up to 54615 of taxable income for married filers and up to 27808 for single filers High.

. Ad Arizona Tax Exemption Certificate Same Day. Arizona Income Tax Range. This establishes a basis for state and city tax deductions or exemptions.

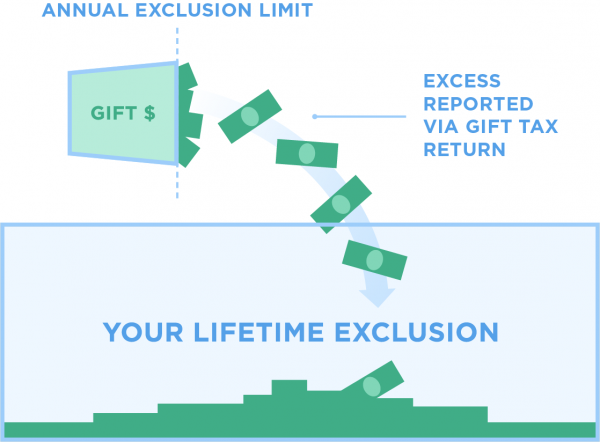

The Internal Revenue Service IRS just announced that the estate and gift tax exemption for 2020 is increasing to 1158 million per person up from 1140 million in 2019. It is to be filled out completely by the purchaser and furnished to the vendor at the time of the sale. How does the estate tax work.

It is often referred to as the death tax. Estates of decedents survived by a spouse may elect to pass any of the decedents unused exemption to the surviving spouse. Form 706 Estate Tax Return Packages Returned If your Form 706 package was returned to you you must.

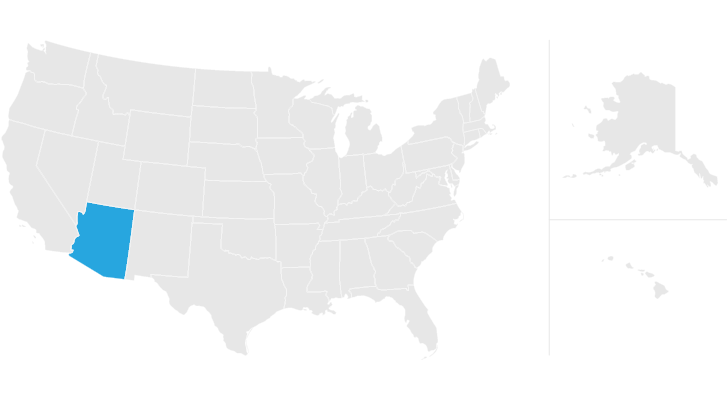

In fact there are no forms or filing requirements to notify Arizona of your estate at all. Federal law eliminated the state death tax credit effective January 1 2005. The estate tax is assessed upon certain states when a person has passed away.

An individual may claim itemized deductions on an Arizona return even if taking a standard deduction on a federal return. 11400000 in 2019 11580000 in 2020 11700000 in 2021 and 12060000 in 2022. TPT Exemption Certificate - General.

If you are like most people you are probably asking What does that actually mean. Fiduciary and Estate Tax. Every corporation doing business pursuant to this article is declared to be a nonprofit and benevolent institution and to be exempt from state county district municipal and school taxes including the taxes prescribed by this title and excepting only the fees prescribed by section 20-167 and taxes on real and tangible personal property.

By 2017 the federal estate tax exemption had risen to 549 million per individual due to the inflation feature and a nearly automatic 1098 million for married couples who follow very specific requirements at the death of the first spouse. Arizona Department of Revenue 602 255-3381 1600 West Monroe Street Phoenix AZ 85007. Tax was tied to federal state death tax credit.

AZ ST 42-4051. On June 18 2019 Vermont enacted H. Exclusion amount under 2010c and 2505 of the Internal Revenue Code and the generation-skipping transfer GST exemption under 2631 as they relate to.

Every authorized society and every society that is exempt under section 20-893 is deemed to be a charitable and benevolent institution and is exempt from all state county district municipal and school taxes including the taxes prescribed by this title except that a society is subject to the fees prescribed by chapter 1 article 2 of this title and. Blank Forms PDF Forms Printable Forms Fillable Forms. The top estate tax rate is 12 percent and is capped at 15 million exemption threshold.

Arizona is one of 38 states that does not assess an estate tax. 45 on 500000 and over of taxable income for married. Get information on how the estate tax may apply to your taxable estate at your death.

If claiming Arizona itemized deductions individuals must complete and. Ad Download Or Email AZ 5000 More Fillable Forms Register and Subscribe Now. Ad estate tax exemption amount.

For the most part an individual may claim those deductions allowable as itemized deductions under the Internal Revenue Code. The trusts Arizona taxable income for the tax year is 100 or more. The exemption amount will rise to 51 million in 2020 71 million in 2021 91 million in 2022 and is scheduled to match the federal amount in 2023.

The Estate Tax Exemption Amount Goes Up for 2021 Serving Queen Creek Gilbert Mesa San Tan and the entire East Valley. This election is made on a timely. The Arizona estate tax return was based on the state death tax credit allowed on the federal estate tax return.

The estates Arizona taxable income for the tax year is 1000 or more. Arizona estate tax exemption. The amount of the federal estate tax exemption is adjusted annually for inflation.

It is to be filled out completely by the purchaser and furnished to the vendor at the time of the sale. This Certificate is prescribed by the Department of Revenue pursuant to ARS. Easily Download Print Forms From.

With the stroke of his pen on December 22 2017 President Donald Trump increased this. Notice 2020-20 Federal income tax filing and payment relief on account of. Exemptions and deductions are specific to each classification.

The purpose of the Certificate is to document and establish a basis for state and city tax deductions or exemptions. Because Arizona conforms to the federal law there is no longer an estate tax in Arizona after January 2005. Complete Edit or Print Tax Forms Instantly.

2022 Current Resources- Arizona Tax Exemption Certificate. No separate state QTIP election permitted. Attorneys personal representatives or fiduciary of a trust or estate can request a Certificate of Taxes from Arizona Department of Revenue based on any of the following.

We Are Providing Services In The Area Of Taxation Laws In Pakistan Income Tax Return Sales Tax Ntn Sales Tax Registration Corporate Law In Pakistan Compan Income Tax Business Tax Tax

Love Builds A Happy Family How To Plan Grieving Process First Love

2021 2022 Gift Tax Rate What Is It Who Pays Nerdwallet

2021 2022 Gift Tax Rate What Is It Who Pays Nerdwallet

2021 Major Tax Breaks For Taxpayers Over Age 65

How To Fill Out A Donation Tax Receipt Goodwill Nne

Arizona Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Arizona Estate Tax Everything You Need To Know Smartasset

Inheritance Tax Here S Who Pays And In Which States Bankrate

Business Taxes Annual V Quarterly Filing For Small Businesses Synovus

States With No Estate Tax Or Inheritance Tax Plan Where You Die

The Owner Operator S Quick Guide To Taxes Truckstop Com

Residential Property Tax Solutions Corelogic

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die